Real Estate Taxes / Homestead Exemption

The Property Appraiser sends Truth in Millage Notices or TRIM notices to all property owners as required by law, usually in August of each year.

The TRIM Notice tells you the taxable value of your property and provides information on proposed millage rates and taxes as estimated by each County taxing authority which includes the County Commission, School Board, Cities, etc. There is a period of time stated in these TRIM notices when you can appeal your assessment, typically in September of each year. In order for you to prove your case and receive tax relief, you should generally be prepared to submit evidence at a VAB hearing which would establish that on January 1 of that year, your property’s "assessed value" was greater than its "fair market value". If you can prove that you have been over assessed than relief should be granted to you and your tax bill reduced.

A Homestead residence is constitutionally protected from huge increases in its assessment each year which is also known as the Save Our Homes Amendment. This Amendment was created in 1992 when voters amended the Florida Constitution so that the Assessed Value of properties with a Homestead Exemption are capped at 3% or the Consumer Price Index (CPI), whichever is less, from its assessment the previous year.

Buyers should be careful of the following scenario when purchasing a residence from a Seller that has had the Homestead Exemption and cap for a number of years. The value of the residence may have appreciated greatly but the real estate taxes for the Seller remained affordable. After the Buyer closes on the home the Seller’s homestead exemption goes away. The Buyer must apply for their own homestead exemption the following year of their purchase. The cap on real estate taxes is removed as allowed by law and the Property Appraiser is allowed to re-assess the residence to its current fair market value. The real estate taxes due for the next tax year could have possibly doubled or even tripled and many times the Buyer was not expecting or prepared this this to happen.

We also assist our clients when they either lose their Homestead exemption or have been denied a Homestead Exemption. Due to the tax savings available when having the Homestead Exemption the loss of this exemption can create financial hardships. We have been able to successfully work with the Property Appraiser’s office to have this exemption either reinstated or granted.

Real Estate Law

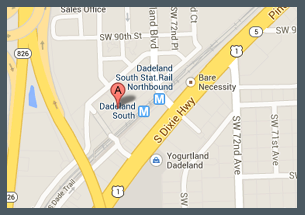

A Real Estate Lawyer can make sure your interests are protected, they are the only party truly “on your side.” Real Estate Lawyer, Barry Simons located in Miami Dade County, offer buyers and/or sellers the protection they deserve.

Title Insurance

Title refers to the rights of ownership and possession of a particular property. Before title can be sold to someone else, it must be marketable - free and clear of liens or other title defects that would be unacceptable to a prudent Buyer in the course of a customary real estate transaction.

Foreclosure

Many homeowners fight foreclosure by hiring lawyers to represent them. Whether you have been a victim of debt collection harassment, facing wrongful foreclosure, being sued by unscrupulous debt buyers, or suffered an investment loss, We can help.